You can use Small Business Accounting Software to manage bookkeeping without having to hire any professional. Also, you can use it to manage stock orders and handle other task management requirements. An efficient high-grade business accounting software helps every business understand the profits and loss, responsibilities, tax, and overall health of the business.

There is a bunch of software in the market that give you the freedom to manage payroll and handle other business in very few clicks. Accounting software for small business includes the following functions:

- Decision Making

- Cost Planning

- Economic performance

What makes an efficient Small Business Accounting Software?

- Smoother user Interface –user experience that will affect your accounting process.

- Cloud Data Processing-you can use this software to access your financial information from any part of the world. Also, you can collaborate with your team members.

- Scalability and Functionality-Software must be compatible with standard apps like dropbox and email tools.

- Support and Data Security–Make are sure the program is totally secure and includes chat, phone support, and other help options.

Here are the top twelve Small Business Accounting software of 2020 for your consideration-

Don’t Miss – Best Tax Software for Small Businesses

List of Best Small Business Accounting Software

1. Zoho Books

Zoho Books is an all-inclusive small business accounting software that helps you manage your business finance and operations from receivables and payables, to collaborating with employees, automating your workflows, monitoring your financials, and much more.

Guaranteed to change the way you do business, Zoho Books’s automation capabilities eliminate data entry, while multi-user collaboration tools, like customer and vendor portals, let you work with your peers and auditors in real time.

This cloud-based software is user-friendly and comes with a zero learning curve. You can extend and customize the functionalities of Zoho Books by seamlessly integrating it with other business apps within the Zoho ecosystem. You can also integrate Zoho Books with a wide range of third-party payment gateways and earn the trust of your customers with a secure payment environment.

From simple expense tracking to managing multiple projects, Zoho Books does it all. It has unique features like multi-currency handling, customer and vendor portals, built-in inventory tracking, transaction approval, auto-scanning, and more that are not easily found in other accounting solutions.

You also get detailed and filtered insights into core areas of accounting so you can make informed business decisions. You also get to oversee changes made to your transactions with activity logs and audit trails.

Zoho Books offers five robust paid plans and a free plan to support young and growing businesses across the globe. You can check out all the features available in Zoho Books plan-wise here. The current standard plan is $10/month, accommodating three users. The mid-tier premium plan supports up to 10 users for $30/month. The high-end ultimate plan supports up to 15 users for $200/month and comes with built-in advanced analytics and inventory controls. Their pricing plans seem to be made with SMBs in mind who look for monetary value in a product and they’ve delivered it in a way that doesn’t compromise the capabilities offered in each plan.

Zoho Book serves as an all-around accounting solution that grows alongside small and medium businesses. If you’re looking for an SMB accounting software, don’t think twice before opting for Zoho Books.

Get a 14-day free trial of the premium plan of Zoho Books to experience for yourself.

2. Fresh Books

Fresh Books has the most interactive and dynamic design surface in an industry, like a very high-quality design surface. It also provides a high range of payment processing and different types of accounting functionality. This can streamline management like invoicing, time tracking, and making payments. It is easy to use, fast, and secure.

It allows you to create invoices, send personalized emails, including logo, signature. Moreover, the Automatic Expense Tracker allows you to link the bank accounts and gets automatic updates. There are tools to track your time and real-time performance. It also has a Mobile and user-friendly software with a luxury user interface that is user friendly and supports multiple languages and currencies.

Also, cloud base software is inexpensive and easy to use. Fresh books offer excellent customer support and customization and accept all types of credit cards also provide a 30 days free trial period. The paid plans start from $6 for lite, $10 for plus, $20 for premiums.

3. Zip books

It is a web-based software that manages and tracks records of all your accounting activities. Zip books offer full accounting services like a ledger, journal, balance sheets. You also get a smart and intelligent expense tracker and billing feature. You can also synchronize all bank accounts, secure all financial needs, allow unlimited invoices, and manage vendors and customers.

Zip books accept all types of digital payment. It is effortless to use, and you can use it without any major complications. Both phone and customer support are available in Zip Books. The software also comes with a 30 days trial period. At present, it supports only English; no other language is supported. It also has few packages the starter kit is free, the starter kit is $15 per month, the sophisticated package $35 per month, and the accountant package depends upon the user and accountant.

4. SlickPie

The third software in this list is Slickpie. It is simple, easy to use, cloud-based software for daily accounting needs. It takes care of all your taxes. Slickpie offers overdue reminders that help you to make payments on time and avoid late payments. You can also manage, track, and access all the information related to your information business.

Furthermore, this accounting software has a great feature. It has a Magicbot that automatically pulls details from the bill and converts that to digital data. You can avail excellent free plans and offer a free trial period. You get email support in the free plan and phone and email support for paid plans. Slickpie supports multiple currencies and accepts all types of digital payments. The Starter kits are free, and pro packages start at $39.95 per month.

5. WAVE

Wave is a comprehensive and integrated software that provides all kinds of solutions for daily accounting needs. It is one of the best software for small businesses, freelancers, and most importantly, totally free of cost. It can track all the expenses and income; you can connect with your bank accounts and sync all expenses. Wave accounting software is effortless to create and send the invoices all in one click; it is effortless to use and comes with unlimited templates. You can read and receive at any time, also without the internet.

Wave is entirely free of cost for lifetimes. No hidden charges are here. That means there is no paid subscription, no charges at all, and it is completely free. Furthermore, it is also compatible with all kinds of mobile services. Furthermore, you can avail an unlimited bank account and credit card connections. There is no limit. It also has a special feature name smart dashboard lets you organize income, expenses, payments, and invoices together. Wave also encrypts all the data connections using 256-bit encryption.

6. QuickBooks Online

It is one of the newest accounting software for small businesses, which offers both clouds based and on-premise versions. It provides solutions for all accounting activities like business payments management, payment of the bills, and the payroll function.

With Quickbooks Online, you can create custom reports, sales receipts, and professional invoices. It offers accounting reports and status. Hence, you can see directly how your business is performing, and at the same time, you can schedule the payments. This accounting software also allows you to track the record expenses for each month when you have to pay your taxes.

Quickbooks Online also offers 3 pricing packages. The simple plan for one user costs $7.50 for a month. The Essentials plan does cost $11.50 for a month for three users. And the Plus costs$15 per month with five users. It offers a 30 days free trial period. The Customer support available via phone calls, emails, chat supports. You can get 24/7 access from any time, anywhere. QuickBooks also offers online Real-time collaborations between team members.

7. Xero

It is one of the newest accounting applications which provides all the accounting tools needed to grow your small business. You can trust Xero for anything related to accounting and bookkeeping. It helps you to track every business vehicle, machinery, and hardware equipment. With Xero, you can complete all tasks like capturing time and costs, sending invoices, and easily monitoring the business progress. It also has a Business performance Dashboard.

A user gets 24/7 customer support via phone calls, chat, and emails. It can also run unlimited payroll services and seamlessly connects with all your mobile devices. It also connects to your bank accounts automatically, running unlimited payroll services. You can avail of the 30 days of free trial periods. It has three packages, and you can choose anyone according to your requirement. You can choose from the starter pack ($20), Standard pack ($30), and premium pack ($40) every month.

8. FreeAgent

Freeagent is also a cloud-based accounting software tool that is perfect for freelancers, small businesses. It brings everything to a single platform. Including invoice, expense and project management, and the sales tax in the same platform. With FreeAgent, you can complete all the activities related to tax and managing it. It offers automated payment services.

Hence, you can generate and manage bills effectively and also customize bills as per needs. Furthermore, you can also create and send invoices to all the clients and track paid invoices. Customer support is always available through phone, ticket, and live chat options.

With its unique Multi-currency and multi-language support, you can send the invoices in 25 different languages. You can also customize your design sections with a wide variety of templates are making things more attractive.

Freeagent provides a 30 days free trial, and it does not provide a free plan and on-premise deployment options. Here you can get only one plan; it costs $12 per month for the first six months for your subscription, and then $24 after that; also gets a 30 days free trial.

9. Tipalti

Tipalti provides end to end solutions to automate the entire payment operations making B2B payment options most fast and efficient. With this accounting software, you can easily guide suppliers through the contact information. Banking details it also provides automated invoice capture, approval, and payments.

Moreover, it collects tax information through digital capture, ensuring payment validation from both ends before it is processed. Tipalti has a special kind of feature which prevents fraud and monitoring the details of payee information. You can avail of Customer support available in the form of telephone, emails.

It is accounting software that offers end to end connections for better security. It also has an in-built self-billing module which automatically creates the invoices. Tiplali accepts payments over nearly 190 countries and 120 currencies. You get round the clock invoice management. The price starts at $299 per month and has two other packages, pro and elite, $699 and $1599 per month. If you get used to the features and mechanism of Tipalti, it becomes easier for you.

10. Invoice Master

It is another excellent accosting platform suitable for small and medium-sized businesses and helps in functions like expenses, creating invoices, and linking bank accounts to organize your business. With Invoice Master, you can get the detailed analytics report in a single click. Additionally, you can get detailed financial reports and visualize them together on your device with the help of a highly new design dashboard.

Invoice Master also has a wide range of invoice templates to customize your logo and signature and send it along with a personalized email. It has a Send Box section that tracks and keeps the history of the invoice you send to your clients. Also, there are download options from where u can download all the pdf.

Invoice Master has three packages- the IM Starter ($7.50), IM Standard ($10), and I’m Professional ($15 per month). You can choose your preferred plan after the trial period of 30 days. Invoice master provides extensive customer support via telephone, email, chat, etc. You can also set up automatic invoices, keep track of the payment status, and update automatically on payment time. Since it is a cloud-based platform, it is effortless to set up and is budget-friendly.

It accepts track and sync payments when u are offline and provides data security-enhanced protocols and automatic reminders for every overdue invoice. You can also send the money in any currency since it accepts all types of payments mode.

11. Accounting seed

Accounting Seed is a highly customized software solution that helps you take care of all accounting related accepts of your business; it is highly flexible, easy to use, and provides a collective, collaborative environment that helps you make strategic business decisions. It offers a wide range of financial reports, including profit and loss, balance sheets, cash flow statements, etc.

This accounting software has many customization tools to configure any business process that includes objects, documents management, securities, and much more. It is User friendly, creates billing and an automated recurring process as per your needs. You can also past, present, and future activities to help manage the bill. Accounting Seed is Cloud-hosted, and therefore, it is easy to set up. Provides customer support via phone, email, and tickets instantly. You can also link multiple banks and multiple customers to your account.

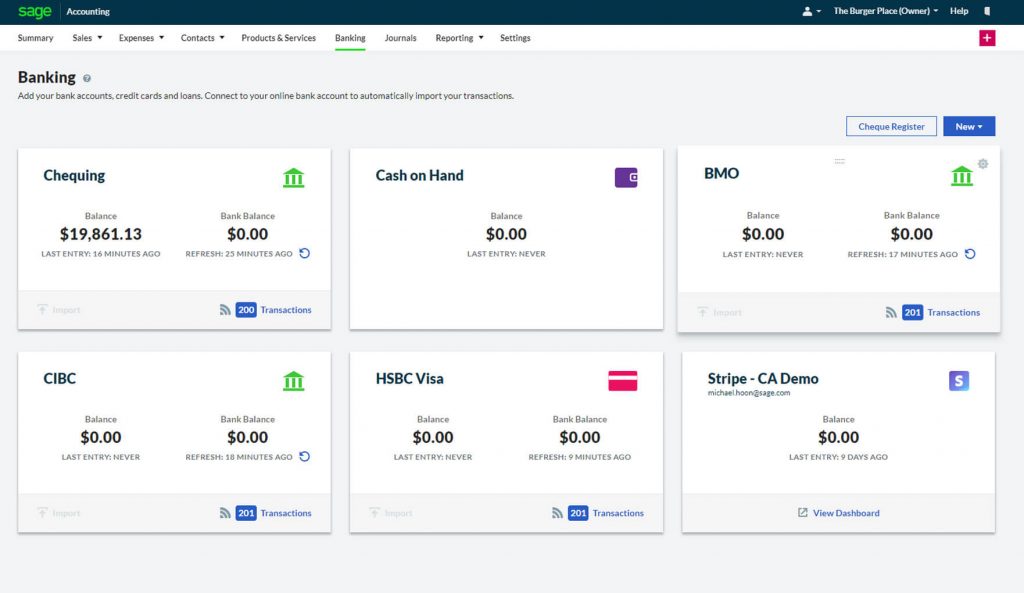

12. Sage cloud accounting

The last one on this list is Sage Cloud Accounting. It is useful for small businesses in professional services. Moreover, this is the most simple and straight accounting solution with great customer service. It operates as a fully functioning accounting system, including general ledgers and all the accounting functions.

Sage Cloud Accounting provides Real-time support, quotes, and estimates and can record purchase invoices, view cash flow statements, and auto entry to remove cash flow entry. It also creates sales invoices and inventory management, views the cash flow statements, removes data entries, and records purchase invoices.

Furthermore, No time tracking functionality is present in this system. This accounting software has core features like Payments to vendors, creating and tracking customers, and invoices. It can also track expenses, income, and money, record payments. Furthermore, it also offers Payroll integration and credit card payments accepted

Best Way to Choose the Right Accounting Software

Account receivable-invoice processing, automatic invoicing, payment processing

Account payable-purchase orders, vendor credit, automatic payments

Payroll-direct deposits, variable wage, Automatic tax calculations

Banking-Bank account preparation, check to handle

Reporting options-standards reports, customizations reports, graph summaries, cost predictions

What to look for before you choose an accounting software?

Small Business Accounting Software is worse than stalled due to legal documents’ mismanagements, which can take months to get resolved, so few questions need to be asked before purchasing your online software. That is-

- What is the quality of the customer service that a company will provide?

- What is the rating of those online sites checked before you purchase?

- Does this provide all the needs that you need for your organization?

- Can you rely on the software for the long term?

- What are the primary features that you require before buying software?

- Are there any additional charges for service that mean the type of hidden cost?

- How is data secured and back up?

Conclusion

Small Business Accounting Software has never been cheaper, usually in the range of $10-$25 a month for a full-service package; it can really serve all the needs of your accounting service.

You can choose any of these 12 business accounting software as per your preference. Each of them is secure and offers great services. Moreover, they offer great features and affordable pricing. The software will offer you what you need, but the cost will be light on your pocket.

Your sensitive information will be safe with them, and all of your accounting needs can be quickly and easily handled.

The payroll software will assist in the capturing, monitoring, and filling of key documents. It is similar to the legal profession, where automation tools reduce the redundant hours spent on filling and paperwork.

No Responses