Tax Software is used in companies to prepare profit and loss statements. It helps individuals in preparing income files for corporate and individual tax returns. Tax Software handles all the compliance issues. One can also use them for e-file tax returns and live tax calculations in less time.

It has got tools that automatically notify you whenever the entered information is mismatched. The best tax software is there to make managing your small business easier. It also makes sure that you do not overpay on your state or federal taxes.

The best online tax filing has got many features. Each software package will have different features depending on your needs. The customers or companies need to make sure that they choose the right one for themselves. When you run a small business, you already have a lot on the plate; therefore, using small business tax software simplifies many procedures that will save you time.

Things, like filling in and copying online forms and filing for different schedules are immense help for beginners. Besides, if you can import figures from previous years, or even accounting software, your workload gets reduced, and the process goes on easily.

Here are the top 7 best Tax Software for Small Business in 2020.

The Best Tax Software

1. Turbo Tax: The respected master of tax return software

TurboTax is a very appropriate and famous selection for small business owners. It has got a long track that has helped to hone its spectacular feature set. There is a downloadable dedicated Business package added. It helps you to solve the foremost advantageous tax-saving strategy for your concern.

It additionally permits you to produce unlimited W-2, 1099-MISC, 1099-INT, and 1099-DIV forms, and prepare tax returns for multiple businesses. Besides that, it allows you to import from QuickBooks. There is countless support accessible, with CPAs and EAs existing, which can be significantly helpful if you are not accustomed to small businesses’ tax filing method.

Turbo Tax: The respected master of tax return software

You can additionally tack a TurboTax package to fit your specific necessities, with the self-employed package helping tackle each personal and business financial gain. Overall, TurboTax is an easy and sensible Tax Software if you want some hand-holding on the means. Intuit Turbo Deluxe will cost you US$59.99.

Pros:

- An all-time favorite

- Help from CPAs and EAs available

Cons:

- Not the cheapest

2. H&R Block: The beefy solution with innumerable features

H&R Block is one of the best small business tax software. It comes with a powerful array of tools to endeavor a lot of complicated problems. As a brand, H&R Block is famous for being one of all the business’s oldest suppliers. However, it will return at a value. Although that is for good output, H&R Block could be a potent answer. There are many small business solutions in the H&R Block market for the self-employed and H&R Block workplace for small businesses.

One of the simplest things regarding it is, if you have a small business with demanding tax affairs, it can speak things through with specialists as a part of the package. You can select from the likes of the H&R Drop-off service, the remote Tax Pro Go, or the practical In-Office answer and every base is lined. H&R has additionally teamed up with Xero, which suggests you furthermore might get accounting advantages too. Tie everything along, and you have now got a comprehensive answer.

H&R Block: The beefy solution with innumerable features

You have to use all its options and features if you choose H&R Block, as it certainly has got a lot. Packages cover a raft of users; however, sole proprietors shall look at Premium online or Self-employed online. Additionally, H&R Block has new merchandise under the Online Assist banner that features on-demand facilitation from a tax expert, registered agent, or CPA. The Deluxe online will cost US$24.49, followed by Premium online at US$37.49 and Self-Employed online at US$57.99.

Pros:

- Beefy features

- Advisors are included in the package.

Cons:

- The cost can be a bit high.

3. TaxSlayer: The bargain tax solution for Self-employed

If you are self-employed, then TaxSlayer’s Self-employed package is best for you as it is ideally suited to the likes of contractors, 1099ers, and different sole proprietors. At a similar time, you get quite a sensible variety of options and functions, and all for an affordable value counting on the present TaxSlayer deal at any given time.

Upon using it for a few days, you shall find TaxSlayer is nicely designed with an intuitive interface, and there is the additional benefit of audit help if needed. Considering its relative affordability, the ability to speak things through support could be a bonus that adds in more value.

TaxSlayer

If you have got fairly fewer necessities and straightforward filing affairs to handle, this self-employed package will match the bill well. You may avoid it if you are running a business wherever you want a comprehensive suite of tools. TaxSlayer’s self-employed bundle is nice; however, it is in no way all set for larger tax tasks. The TaxSlayer classic will cost US$17, followed by Premium at US$37 and Self-Employed online at US$47.

Pros:

- An affordable option

- Phone and online support included

Cons:

- It is not suitable for SMBs.

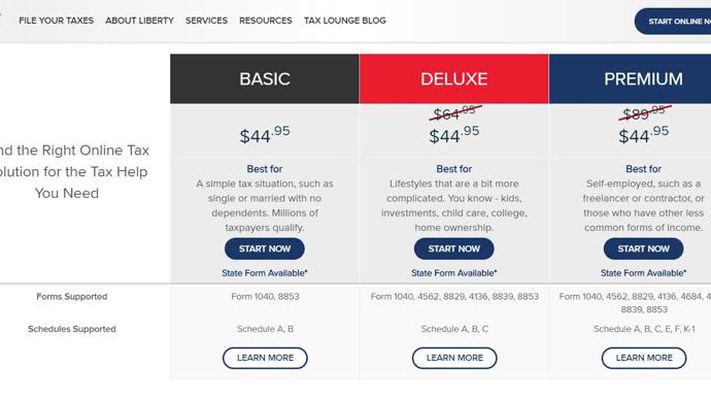

4. Liberty Tax: Delivers you both online and face-to-face filing

Liberty Tax is available online in three editions, Basic, Deluxe, and Premium. It is an affordable choice, especially for small business owners. The Deluxe version of Liberty Tax is made for self-employed business people. The Premium package completely suits S corporations. The Basic is used to sort the simplest of tax affairs, and it does not appeal to SMBs.

In addition to all of its features, there is the back-up appeal of mixing cloud-based tax preparations along with site options. It allows you to mix and match your filing duties. If you are not confident with your filing duties, you can take help from online chat or mail them. You can also get in-person help to go through your issues. The software also offers you online and classroom-based tax courses, which can help you get on top of your taxes.

LibertyTax

Liberty Tax users face problems with some aspects of its usability. Liberty Tax has got strong customer support. If you are okay with these, Liberty Tax can be a nice choice for Tax Software, especially with its face-to-face assistance. The Liberty Tax Simple will cost you US$13.97, followed by the Basic at US$20.97 and Deluxe at $94.97.

Pros:

- Personal touch

- Pretty straightforward

Cons:

- Fairly minimalistic

- Avoid if you are an online person.

5. eFile: No frills business tax solution

Another option if you are trying to find a simple-but-effective means to tackle your tax is eFile. This online-only choice presently comes in 3 different packages, with a Free Basic being solely appropriate for traditional W-2 financial gain affairs. However, eFile is pretty helpful if you are a self-employed business person.

While eFile is not extremely aimed, or so prepared for larger businesses because of its inability to allow you to file the firms’ kind 1120 using the service. It is additionally helpful for SMBs.

eFile: No frills business tax solution

Going down the eFile route means that you will, in all probability, wish to bypass the Deluxe edition and opt for that Premium model. Whereas eFile contains a slightly light-hearted feel to its approach, usually speaking, this can be a solid and reasonably-priced choice.

Pros:

- Decent features

- Cheaper

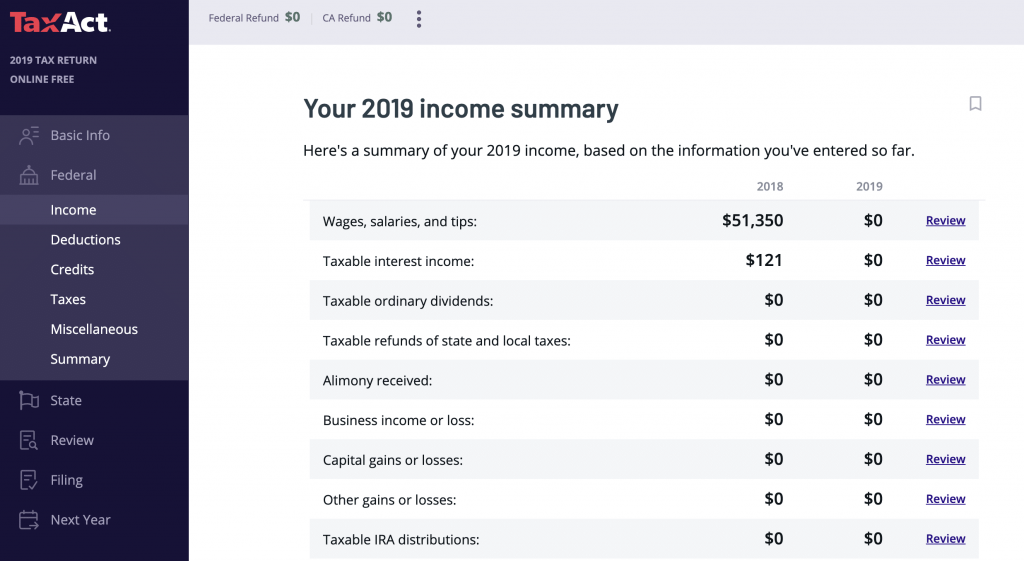

6. TaxAct: The simplest tax solutions

The TaxAct Software is geared toward business and is well-known for being straightforward to use, quick and cheap. It is a perfect resolution for several SMBs. Currently, the TaxAct Business product permits you to start without charge, i.e., it is the best free tax software. It can also come in a paid-for setup if you have determined whether or not or not, it works for your desires.

Sole Proprietor, as an example, covers kind 1040, Schedule C, whereas the Partnership package tackles kind 1065. Meanwhile, C Corporation, Form 1120, and the S Corporation, Form 1120S bundles deliver identical initial flexibility due to a pay-when-you-file approach. There is a tax-exempt Organization, Form990 choice out there too.

TaxAct

Usefully, the TaxAct website helps you deal with that package that is best suited to your desires and tailors a package to suit. You get a solid, direct approach, with countless facilitates, the power to import last year’s returns and alternative information entry, and unlimited free support that adds a great deal of usefulness.

Pros:

- Good level of support

- Tailored package

Cons:

- The state cost is higher than the competition.

7. FreeTaxUSA: Cheapest option with straight forward features

FreeTaxUSA may not be the simplest choice to head for if you have additional sophisticated small business tax affairs to get sorted. For example, Form 1120 for a company. It is one of the cheapest Tax Software. However, its value at a glance if your tax affairs are pretty monotonous as FreeTaxUSA offers basic practicality via a simple-to-use interface.

While there are apparently Simple and Premium choices out there, small business owners prefer to move straight for the Advanced package to confirm there are enough tools to urge the work done. There’s a charge for State returns too. One bonus is that the straightforward import of a previous year returns from TurboTax, H&R Block, or TaxAct if you’re trying to alter.

FreeTaxUSA

FreeTaxUSA gets thumbs up for its Advanced bundle because it helps all business financial gain varieties, with a raft of the most important forms is all supported. Beefing up the attractiveness of FreeTaxUSA is that the service will perform real-time observation as you enter data, control things once you’ve completed a section, and then run a final check before you e-file.

Pros:

- Low cost

- Guaranteed to be correct

Cons:

- Limited to smaller business

Concluding

Depending on your requirements and business size, you can choose among the top 7 best Tax Software and ease your business handling. Each one of them has unique features worth using.

I like this picture because of the person behind the camera.

No Responses